Published November 14, 2019

This is Not 2008 All Over Again: The Mortgage Lending Factor

Good news for homebuyers! Mortgage rates are low & credit is available to qualified buyers. Call us today...we can help!

info@buddyfrey.com 704-409-4900

This is Not 2008 All Over Again: The Mortgage Lending Factor

|

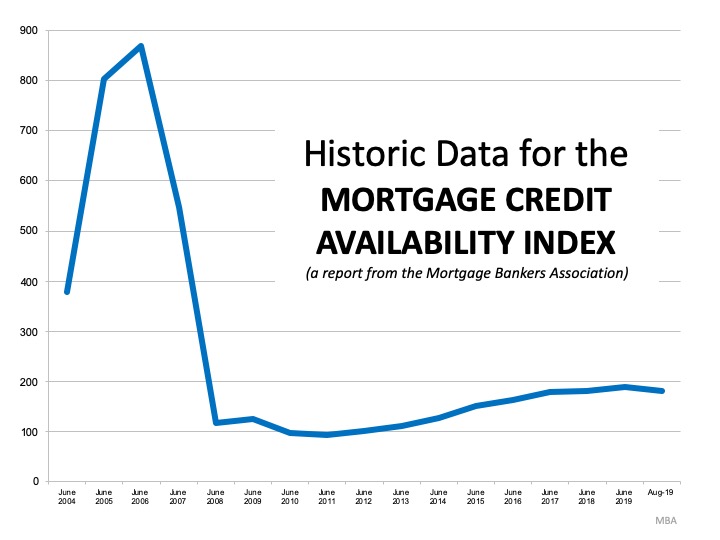

Some are afraid the real estate market may be looking a lot like it did

prior to the housing crash in 2008. One of the factors they’re pointing at is

the availability of mortgage money. Recent articles about the availability of

low-down payment loans and down payment assistance programs are causing

concern that we’re returning to the bad habits of a decade ago. Let’s

alleviate the fears about the current mortgage market. The Mortgage Bankers’

Association releases an index several times a year titled: The

Mortgage Credit Availability Index (MCAI). According to their website: “The MCAI provides the

only standardized quantitative index that is solely focused on mortgage

credit. The MCAI is…a summary measure which indicates the availability of

mortgage credit at a point in time.” Basically, the index determines how easy it is to get a mortgage. The

higher the index, the more available the mortgage credit. Here is a graph of the MCAI dating back to 2004, when the data first

became available: Thankfully, lending standards have eased since. The index, however, is

still below 200, which is half of what it was before things got out of control. Bottom Line

It is easier to get a mortgage today than it was immediately after the

market crash, but it is still difficult. The difference in 2006? At that

time, it was difficult not

to get a mortgage. |